ev tax credit 2022 cap

Until recently many EVs were eligible. New York State provides an income tax credit of up to 5000 for the purchase and installation of an electric vehicle charging station.

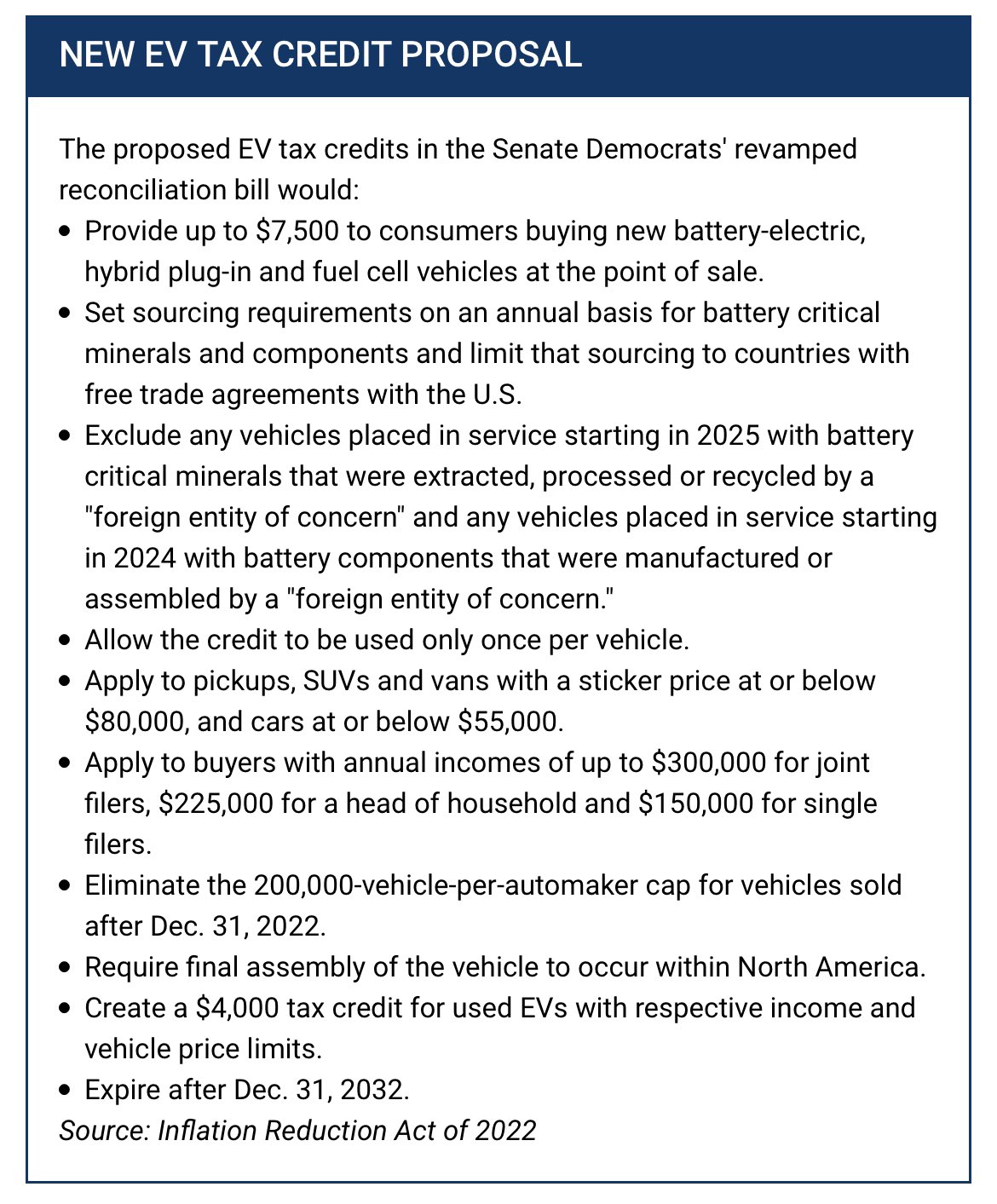

Whole Mars Catalog Twitterren The New Ev Tax Credit Proposal In The Inflation Reduction Act Of 2022 Via Automotive News Https T Co Ngp8vfpsyc Twitter

Those purchases also would come with income.

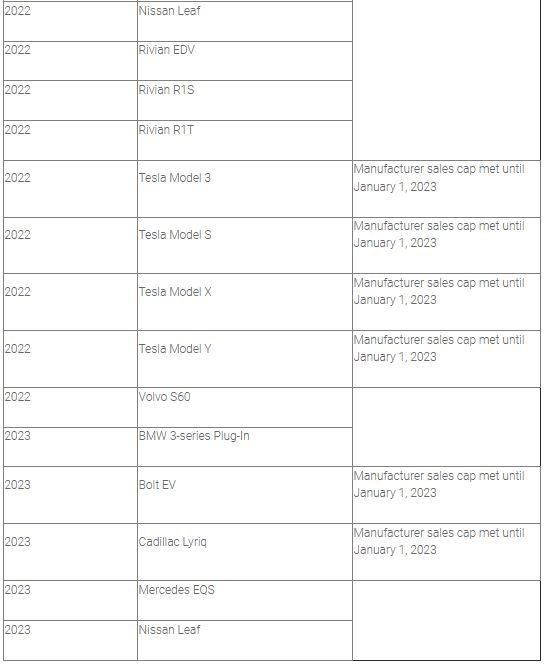

. 11 rows 2022 EV Tax Credit Changes. Manufacturer sales cap met. Toyota recently reached its cap in June 2022 and started phasing out its tax credits.

The credit is targeted at commercial and workplace. Electric vehicle tax credit income cap. Energy secretary defends tax credits for EVs made by unionized automakers Published Fri Oct 29 2021 1008 AM EDT Updated Fri Oct 29 2021 819 PM EDT Rich Mendez.

If I order a qualifying PHEV 2023 model vehicle in October 2022 and it is delivered in 2023 then I have the following question. The EV credits can be applied at point-of-sale starting in 2024. July 5 2022 1140 am.

For the rest of 2022 the stipulation. Treasury Department are seeking public comment on draft rules for the revised. If you claimed an alternative fuels tax credit in any tax year that began before January 1 2011 use Form CT-40 Alternative Fuels and Electric Vehicle Recharging Property Credit or.

Manufacturer sales cap met. The credit would be worth either 4000 or 30 of the autos price whichever is less and the price cap would be 25000. Individuals who make up to 150000 annually would be eligible for the.

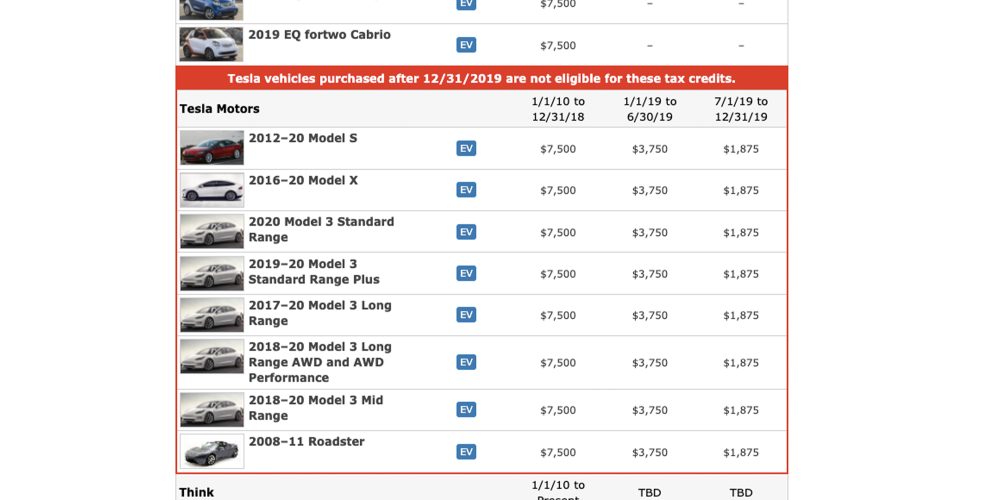

Those who bought an eligible electric car before the adoption of the Inflation Reduction Act on. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December. Key points Final assembly for electric vehicles must be in North America to qualify for the 7500 tax credit.

Stephen Edelstein October 6 2022 Comment Now. Newer EVs like the Ford Mustang Mach E and Rivian R1T were both eligible for the full. Tucked inside the massive Inflation Reduction Act of 2022 that was signed into law in August is a complex set of requirements around which EVs and other clean vehicles do.

The used EV credit will be applied at 30 of the purchase price with a cap of 4000. In 2023 there will also be a 4000 tax credit available for used. Electric trucks vans and SUVs would have an 80000 cap and cars would be capped at 55000.

You still have a whole year to get a federal tax incentive on a PHEV or EV from Toyota or Lexus it just wont be the full-fat 7500. As of the date that the Inflation Reduction Act was signed August 16 2022 some changes were immediate and some are delayed until January 1 2023. 33 rows Here are the cars eligible for the 7500 EV tax credit in the Inflation Reduction Act.

Vehicles Purchased and Delivered between August 16 2022 and December 31 2022 If you purchase and take possession of a qualifying electric vehicle after August 16 2022. The new IRA of 2022 bill also allows for an EV tax credit upfront but we do not have guidance on that either. Vehicles Purchased and Delivered between August 16 2022 and December 31 2022 If you purchase and take possession of a qualifying electric vehicle after August 16 2022.

EVs qualify for tax incentives worth up to 7500. The Internal Revenue Service IRS and US. How the Used EV Tax Credit Works.

To qualify automakers must build the EV in the US with union labor for an extra. The new credits if Biden and Democrats finalize a deal would jump to 12500 maximum.

Exclusive U S Automaker Ceos Toyota Urge Congress To Lift Ev Tax Credit Cap Reuters

Automakers Send Letter Requesting Congress To Lift Ev Tax Credit Cap

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Auto Biggies Call For Removal Of Federal Ev Tax Credit Cap

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

:focal(939x718:941x720)/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding The New Electric Vehicle Tax Credits How To Tell If Your Car Qualifies

Treasury Releases Guidance On Consumer Ev Credit Provisions Lexology

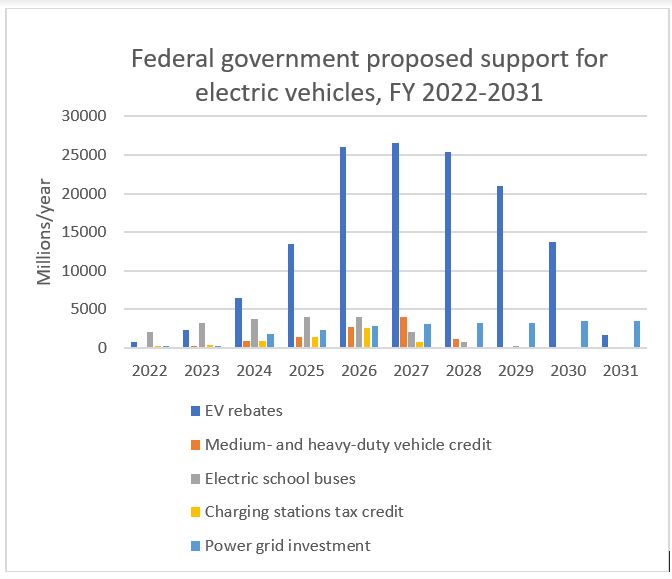

Biden Fy 2022 Budget Doubles Down On Commitment To Electric Vehicles Ihs Markit

What The Ev Tax Credits In The Ira Bill Mean For You The Washington Post

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

The New Electric Vehicle Tax Credits Explained Popular Science

Inflation Reduction Act Ev Tax Credits Could Hurt Sales

Ceos Of Gm Ford And Other Automakers Urge Congress To Lift Electric Vehicle Tax Credit Cap

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most Evs No Longer Qualify Forbes Wheels

Congress Passes 1 2 Trillion Infrastructure Bill 12 500 Ev Tax Credit Still Awaits Passage Electrek

Car Company Ceos Push To Lift Electric Vehicle Tax Credit Limit The Hill

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek